Advanced Financial Scenario Modeling

Master the art of financial forecasting through hands-on scenario modeling techniques. Our comprehensive program bridges theoretical knowledge with practical application, preparing you for real-world financial challenges.

Start Your Journey

Program Structure

Our 18-month program is designed around three progressive phases that build your expertise systematically.

Foundation Phase

Six months of core financial principles, statistical analysis, and basic modeling techniques. You'll work with historical data and learn to identify patterns that drive financial decisions.

Application Phase

Eight months of advanced scenario development, risk assessment, and model validation. Students tackle real-world case studies from various industries and market conditions.

Mastery Phase

Four months focused on independent project work, presenting findings, and developing expertise in specialized areas like stress testing or regulatory compliance modeling.

Meet Your Instructors

Learn from professionals who've spent decades building and testing financial models across different market cycles.

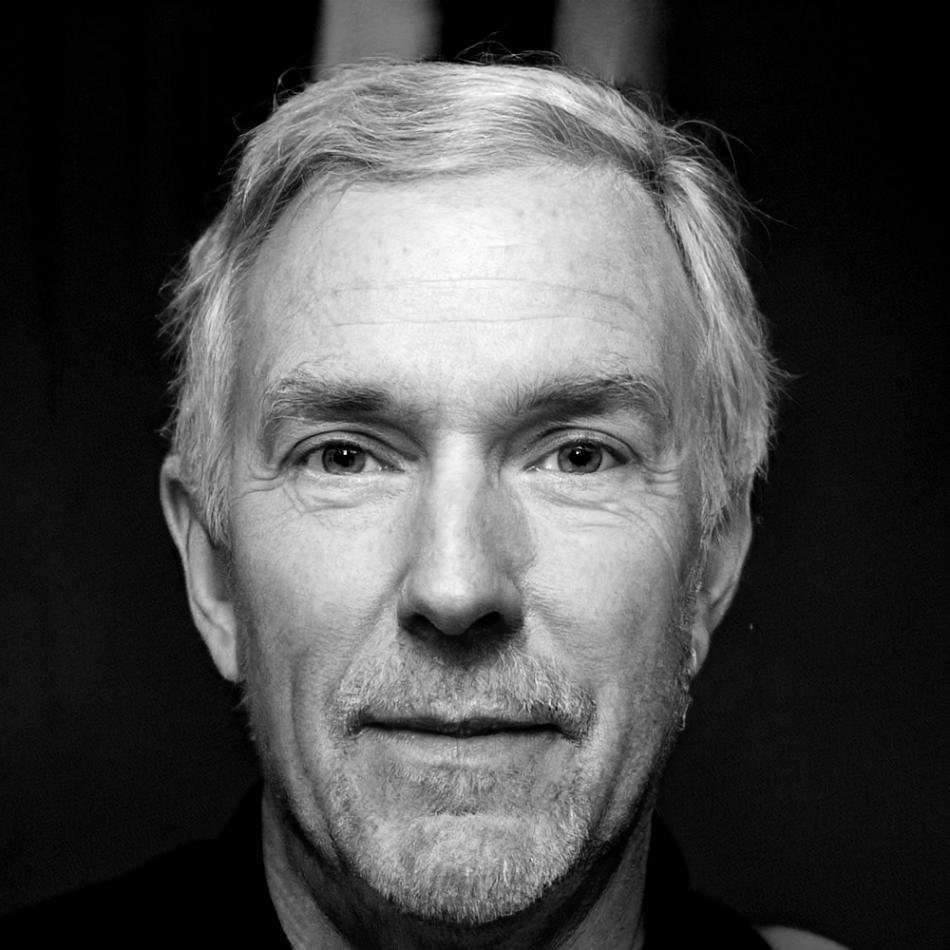

Thaddeus Grimwick

Senior Risk Analyst

Twenty years modeling credit risk for major Australian banks. Specializes in stress testing and regulatory scenario development.

Zelda Nightshade

Market Research Director

Former hedge fund strategist with expertise in macroeconomic modeling and portfolio scenario analysis. Published researcher in quantitative methods.

Beaumont Sludgeworth

Corporate Finance Manager

Built financial planning models for ASX-listed companies. Teaches practical approaches to business valuation and growth scenario modeling.

Crispin Moldwarp

Quantitative Strategist

Previously developed algorithmic trading models. Now focuses on teaching Monte Carlo methods and sensitivity analysis for financial forecasting.

What You'll Study

Our curriculum covers both traditional financial analysis and modern computational approaches to scenario modeling.

Financial Statement Analysis

- Cash flow modeling techniques

- Working capital projections

- Revenue forecasting methods

- Cost structure analysis

Risk Assessment Methods

- Value-at-risk calculations

- Stress testing frameworks

- Correlation analysis

- Tail risk measurement

Market Analysis

- Economic indicator interpretation

- Interest rate modeling

- Currency risk scenarios

- Commodity price forecasting

Quantitative Techniques

- Monte Carlo simulations

- Sensitivity analysis

- Optimization methods

- Statistical validation

Model Development

- Spreadsheet automation

- Database integration

- Visualization techniques

- Documentation standards

Industry Applications

- Banking and credit analysis

- Insurance scenario planning

- Corporate budgeting

- Investment valuation

Enrollment Information

Program Start

September 2025

Duration

18 Months

Format

Hybrid Learning

Classes meet twice weekly in our Geelong facility, with additional online workshops and project sessions. The program includes access to professional financial databases and modeling software. Applications are reviewed on a rolling basis through July 2025.